Josh Brown's "Best Stocks in the Market:" Real Estate

CNBC Josh Brown’s

TUE, FEB 17th 2026

Housing Market Update | Week of January 5th

Published: January 5, 2026

Updated: January 5, 2026

Add Your Heading Text Here

The Mortgage News

Published February 14, 2026

Published February 14, 2026

New York Fed Finds Local Economies Are “Starting to Crack”

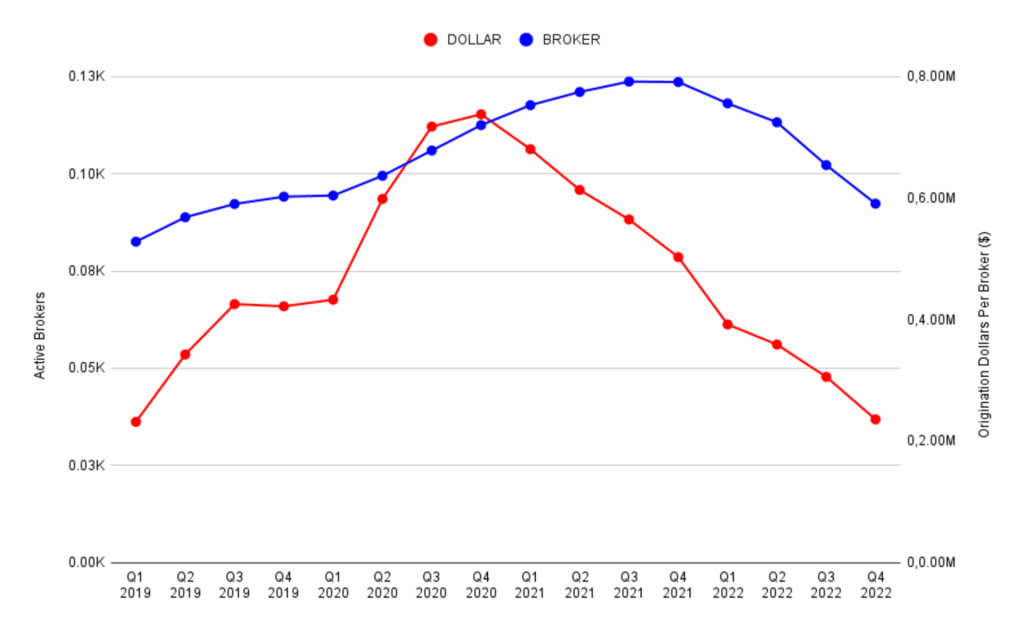

Active Brokers vs Origination Dollars:

FEDERAL RESERVE

Fed hold key interest rate steady as economic view improves

PUBLISHED WED, JAN 28 2026 2:00PM EST | UPDATE WED, JAN 28 2026

The Mortgage News

ByTMN EditorReading Time: 2 minutes

More Americans Benefited From A Refi In January As Rates Drifted Towards 6%

Early January brought refinancing opportunities for many Americans as declining rates unlocked potential savings, according to ICE’s February 2026 Mortgage Monitor Report.

Near-6% rates helped boost affordability to a four-year high. At that level, as many as 5 million Americans would save money every month by refinancing.

“When rates hit 6.04% on January 9, the number of homeowners in the money to refinance jumped by 20%,” said Andy Walden, Head of Mortgage and Housing Market Research at ICE.

Some of those savings have dissipated as rates inched up into February, but the data underscores how even small changes can benefit borrowers in today’s market.

The number of mortgages with 6%+ rates now exceeds those below 3%, a major reversal from the pandemic refinancing boom and sea change for refi demand. More borrowers can benefit from making a change in today’s environment.

“That said, affordability remains structurally challenged, with home prices still elevated relative to incomes and meaningful differences emerging across regions and borrower segments,” Walden added.